By Steve Syre

New research from the LTSS Center details large differences in the value of assets held by white, black and Hispanic older adults.

Economic disparities between older white Americans and minority elders extend beyond well-established income gaps to include much more dramatic differences in the value of assets they own, according to new research by the LeadingAge LTSS Center @UMass Boston.

The analysis, performed for the National Council on Aging, found:

- White older adults reported household income levels about twice those of black and Hispanic older adults.

- Non-housing assets owned by white older adults were 4 to 7 times more valuable than comparable assets owned by black and Hispanic older adults.

- The primary residences owned by white older adults were substantially more valuable than those owned by older blacks and Hispanics.

“Income certainly plays a critical role in the economic well-being of seniors, but the value of assets they own is also an important factor influencing their overall financial health,” said Marc Cohen, co-director of the LTSS Center. “We found very large disparities in all these categories, which puts minority older adults in a far more precarious position should they face unexpected expenses in retirement. They have little cushion to deal with retirement risks like illness, loss of a spouse, and economic downturns.”

A WIDE GAP IN INCOME LEVELS

The LTSS Center research was based on data from the 2014 Health and Retirement Study examining a representative sample of 12,556 households of older adults living in the United States.

The analysis showed that white households age 60 and older reported incomes roughly double that of older black and Hispanic households. Researchers found:

- Older white households had average incomes of $87,318 per year. The average income for older black households was $41,633, while older Hispanic households averaged $44,679 per year.

- The median household income was $50,200 for older whites, compared to $22,833 for older blacks, and $20,640 for older Hispanics.

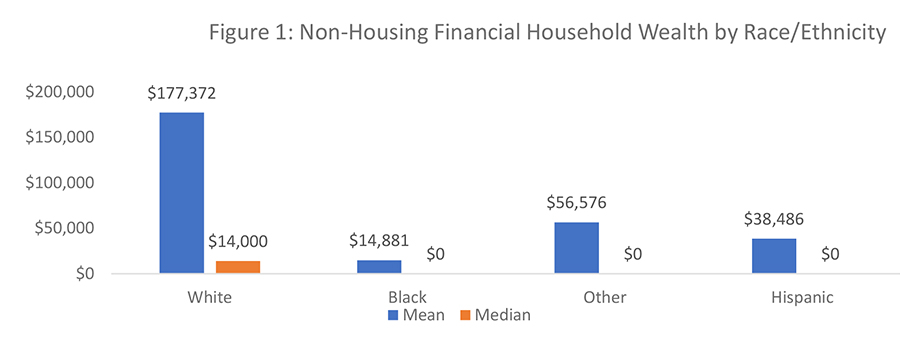

DISPARITIES IN ASSET VALUES ARE MUCH LARGER

Race/ethnicity-based disparities in the value of assets owned by American older adults were even more dramatic. The study found:

- Older white households reported non-housing financial wealth of $177,372 on average, compared to $14,881 for older black households, and $38,486 for Hispanic households age 60 and older.

- The median non-housing wealth measures were much lower across the board, but the same race/ethnicity-based disparities remained. The median non-housing financial wealth for older white households was $14,000, compared to $0 for older black and Hispanic households.

“The wide gaps between average and median asset values across all racial/ethnic groups suggest that wealth is highly concentrated at the upper levels and also at the lower end of the wealth spectrum,” said Jane Tavares, a LTSS Center research associate who worked on the analysis.Similar racial/ethnic disparities were also evident in an analysis of the net values of primary residences owned by older households. These figures take outstanding mortgages on properties into account. The study found:

- On average, the net value of primary residences for older white households was $151,347. In comparison, the net value was $63,796 for older black households and $92,125 for older Hispanic households.

- Median measures were significantly lower but continued to reflect racial/ethnic disparities. The median net values of primary residences were $95,000 for older white adults, $14,507 for older black adults, and $25,000 for Hispanics age 60 and older.

A measure of cash-on-hand and basic savings illustrated similar disparities:

- Older white adults had an average of $43,397 in checking, savings, and money market accounts. Comparatively, older blacks held an average of $9,138, and older Hispanics held $9,176, in those accounts.

- Those same white older adults had a median value of $7,000 in checking, savings, and money market accounts, while older black adults had median account balances of $100. Hispanic older adults had a median zero balance.

“It’s clear economic disparities between whites and minorities persist in retirement,” said Cohen, who is also director or research at the Center for Consumer Engagement in Health Innovation at Community Catalyst. “The implication is that minority older adults are less able to absorb financial and health shocks during retirement. They are also unable to pass much wealth on to their children, perpetuating inter-generational disparities.”